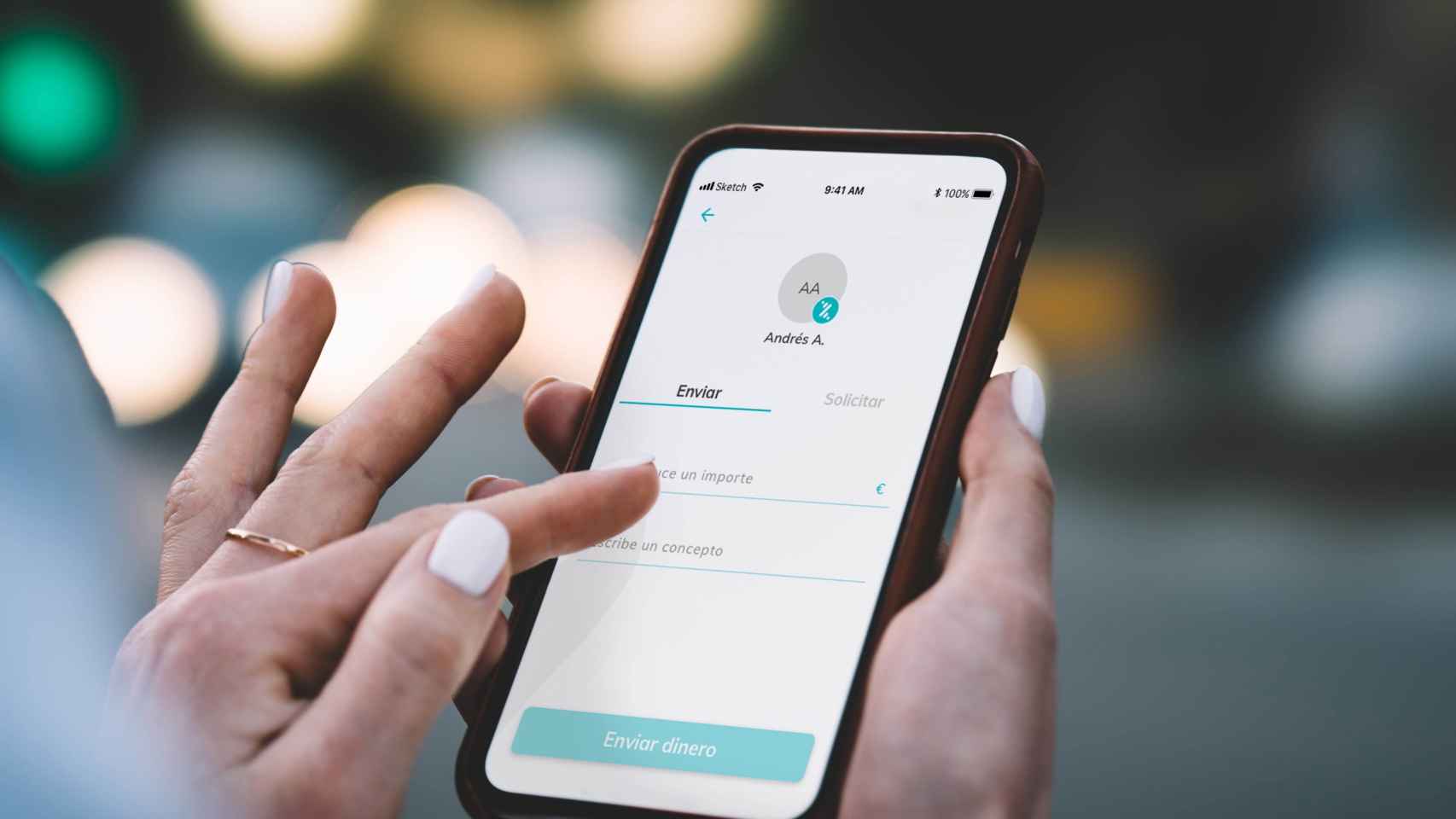

Smartphones in Spain are no longer just devices for making calls. With their versatility, they can serve as music players, task managers, and even tools for banking transactions. All major banks in Spain offer mobile applications for Android and iOS, allowing users to perform various banking operations remotely without the need for a computer.

However, caution is necessary when using these banking apps due to the sensitive information they contain. It is important to choose a strong and secure password, avoiding easy-to-guess combinations and patterns. Additionally, setting up a complex pin for transactions and enabling two-step verification for added security is advisable.

Regularly updating the banking app is crucial as developers continually release performance and security enhancements to protect user data from potential threats. It is recommended to install updates promptly or enable automatic updates to ensure the app’s security is up to date.

Using public WiFi networks, especially unsecured ones, poses risks as cybercriminals can intercept data transmitted over these networks. It is best to avoid conducting any banking transactions on public WiFi and consider using a VPN to encrypt network traffic for added protection.

Beware of malware, such as adware and keyloggers, that can compromise device security and steal sensitive information, including passwords. Only download apps from official sources like Google Play to reduce the risk of installing malicious software on your device.

In conclusion, safeguarding your smartphone and data is essential when using banking apps or other sensitive applications. By following these security measures and best practices, users can minimize the risks associated with mobile banking and ensure their personal information remains secure.